In the realm of nonprofit organizations, the annual “tax” return requirement might raise questions, especially when tax-exempt status is in place. This piece of our series, “Stepping Stones: Paving the Path to Nonprofit Financial Success,” delves into the pivotal role of filing tax returns and highlights key motivations for nonprofits to engage in this practice. Beyond mere compliance, these insights spotlight the ways in which embracing tax obligations can catalyze growth and bolster credibility for nonprofits.

The Significance of Annual "Tax" Returns

Most nonprofit organizations, while exempt from federal income taxes, must file an annual information return with the IRS containing vital financial, governance, and operational data. These reports are open to the public, promoting transparency and allowing stakeholders and supporters to understand the nonprofit’s mission and finances.

Successful nonprofits demonstrate fiscal responsibility and transparency by consistently submitting these returns, attracting stakeholders who value financial integrity. Additionally, these reports help determine the allocation of expenses towards programmatic activities, emphasizing the commitment to the organization’s core mission.

Through careful financial reporting, nonprofits establish trust among stakeholders and the public, reinforcing their dedication to accountability and transparency, which is crucial for their growth and credibility.

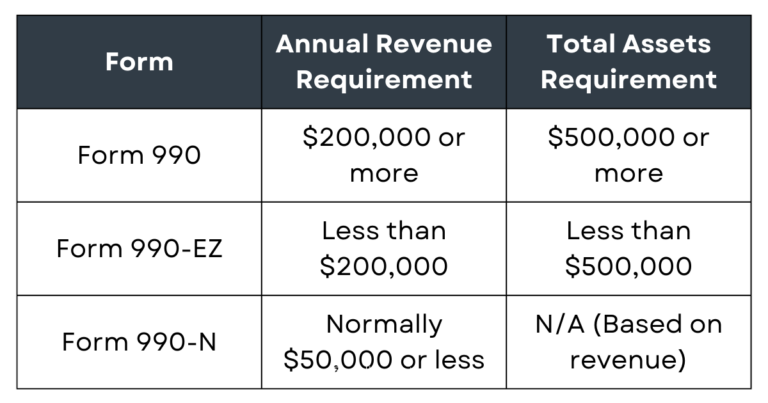

Here’s a simple chart that provides a clear breakdown of the IRS forms most nonprofits would file based on their annual revenue and/or assets. It helps nonprofits ensure they meet their reporting obligations accurately. Nonprofits can use this chart as a quick reference guide to determine which form is appropriate for their organization.

Beyond the Realm of Compliance

Building trust and confidence in a nonprofit organization is essential. Sharing annual tax returns and financial insights voluntarily shows accountability and dedication to the mission, attracting support and involvement from stakeholders and volunteers.

To secure grants, keeping financial filings updated is crucial. Well-prepared returns signal responsible management, increasing the chances of obtaining funding.

Analyzing financial data empowers leaders to make informed decisions about resource allocation and program growth. It helps identify strengths and weaknesses, ensuring efficient resource use and proactive financial management.

Highlighting low administrative and fundraising expenses compared to program expenses demonstrates responsible stewardship of funds, making the organization more appealing to donors and other stakeholders.

Wrap-Up

Filing annual “tax” returns stands as a pivotal responsibility for nonprofit organizations. Beyond meeting legal requisites, such filing serves as a channel to exhibit financial transparency, attract stakeholders, and align with best practices in the nonprofit domain. Embracing tax obligations epitomizes the commitment of a nonprofit to effecting positive change in society.

In our next and final installment of this series we will cover why nonprofits need to make financial transparency a priority and how to go about establishing processes to ensure this.

NFP SmartStart

Built specifically for small and/or start-up nonprofits. NFP SmartStart provides accounting best practices, compliant processes, accurate financial data, and meaningful reporting, to help you lead your organization to the next level.

Read the Full Series

Stepping Stones: Paving the Path to Long-Term Financial Success

Share This Post:

Chazin

With over 20 years working exclusively with nonprofits, we pride ourselves in having a unique understanding of nonprofit accounting needs. We believe that nonprofits deserve personalized, quality service and should not settle for a one-size-fits-all approach. We collaborate with you to provide a fully virtual and customized solution that is not only cost-effective but also strengthens your accounting function. We offer a team of industry experts at your disposal to provide advice, leading technology, and to supplement existing staff to improve efficiency and compliance.